knoxville tn sales tax rate 2020

With local taxes the. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Sales Tax On Grocery Items Taxjar

67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

. Rate per 100 value. Payments be mailed to the City of Johnson City PO. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually.

It comes standard with a 53L Eco Tec3 V8 engine and a 6-speed automatic transmission. Free online 2021 Q1 US sales tax calculator for 37902 Knoxville. Exact tax amount may vary for different items.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Tennessee Tax Rates for Northeast Tennessee By County and City Tennessee is one of only a few states with NO state Income Tax. The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway.

State Sales Tax is 7 of purchase price less total value of trade in. Submit a report online here or call the toll-free hotline at 18002325454. 2022 Tennessee state sales tax.

Local collection fee is 1. The next largest sources are local sales taxes 25 and intergovernmental revenues 11 which include a share of income and state shared sales taxes. Thus the sale of each property is made subject to these additional taxes.

Current Sales Tax Rate. The Tennessee sales tax rate is currently. Tax Rates for Knoxville TN.

Fast and easy 2021 Q1 sales tax tool for businesses and people from 37902 Knoxville Tennessee United States. Monday - Friday 800 am - 430 pm Department Email. County Property Tax Rate.

Second 2020 tax-free weekend. The County sales tax rate is. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000.

000 The total of all income taxes for an area including state county and local taxes. This amount is never to exceed 3600. 925 7 state 225 local City Property Tax Rate.

Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Box 70 knoxville tn 37901 phone. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated.

The current total local sales tax rate in knoxville tn is 9250the december 2020 total local sales tax rate was also 9250. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS. Sales Tax Knoxville 225.

This is the total of state county and city sales tax rates. There is no applicable city tax or special tax. 7-9 retail sales of food and drink by restaurants and limited-service restaurants.

Tennessee has 779 special sales tax jurisdictions with local. Local Sales Tax is 225 of the first 1600. The Knoxville sales tax rate is.

Mailing Address Knox County Trustee PO. Comptroller of the Treasury Jason E. 4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is.

The 2020 Chevrolet Tahoe is a popular full-size SUV in Knoxville TN for drivers that need a powerful vehicle that can haul equipment and still over a comfortable ride. This tax is generally applied to the retail sales of any business organization or person engaged. Local Tax Rate Effective Date Situs.

This is the total of state county and city sales tax rates. Purchases in excess of 1600 an additional state tax of 275 is added up to a. The state of Tennessee also announced that for 2020 only on the weekend of Aug.

Sales or Use Tax Tenn. The december 2020 total local sales tax. Tax Sale dates are determined by court proceedings and will be listed accordingly.

The citys fiscal 2020 rate-adjusted 10-year revenue CAGR of about 25 was above the rate of inflation. 925 The total of all sales taxes for an area including state county and local taxes Income Taxes. 212 per 100 assessed value.

The minimum combined 2021 sales tax rate for knoxville tennessee is. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. The Knoxville sales tax has been changed within the last year.

31 rows The state sales tax rate in Tennessee is 7000. Knoxville TN 37902. You can print a 925 sales tax table here.

It was raised 05 from 7 to 75 in October 2021 lowered 075 from 775 to 7 in October 2021 raised 025 from 75 to 775 in October 2021 raised 05 from 7 to 75 in September 2021 lowered 075 from 775 to 7 in September 2021 raised 025 from 75 to 775 in. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Knoxville tn sales tax rate.

Last item for navigation. 24638 per 100 assessed value. Box 70 Knoxville TN 37901 Phone.

05 lower than the maximum sales tax in TN. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

Sales Tax On Grocery Items Taxjar

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Tennessee Car Sales Tax Everything You Need To Know

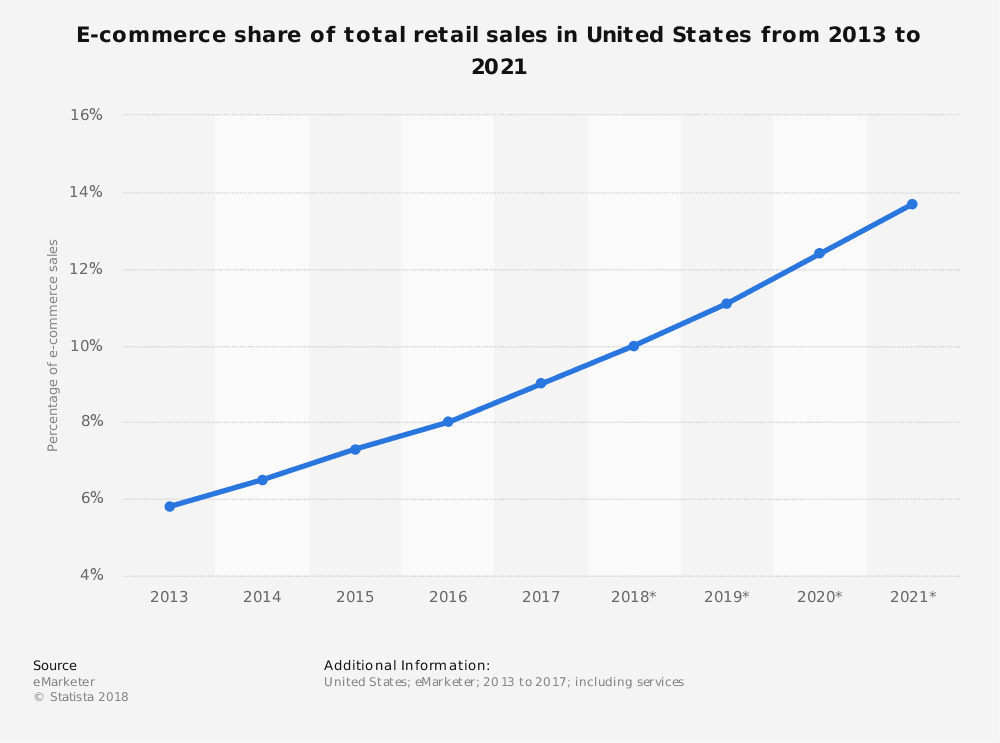

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

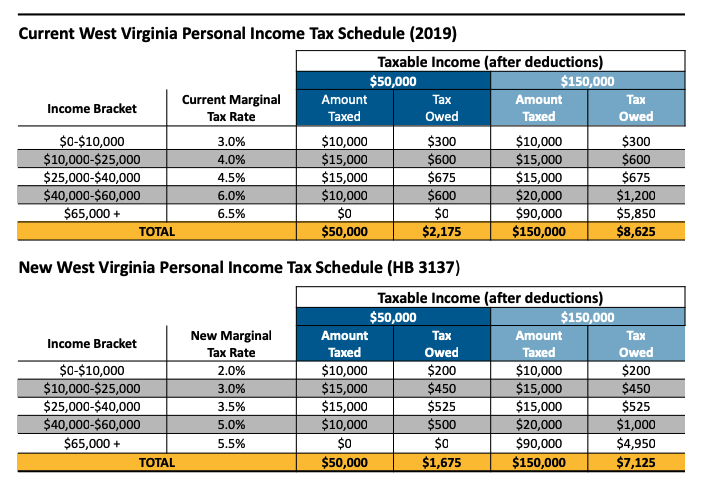

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

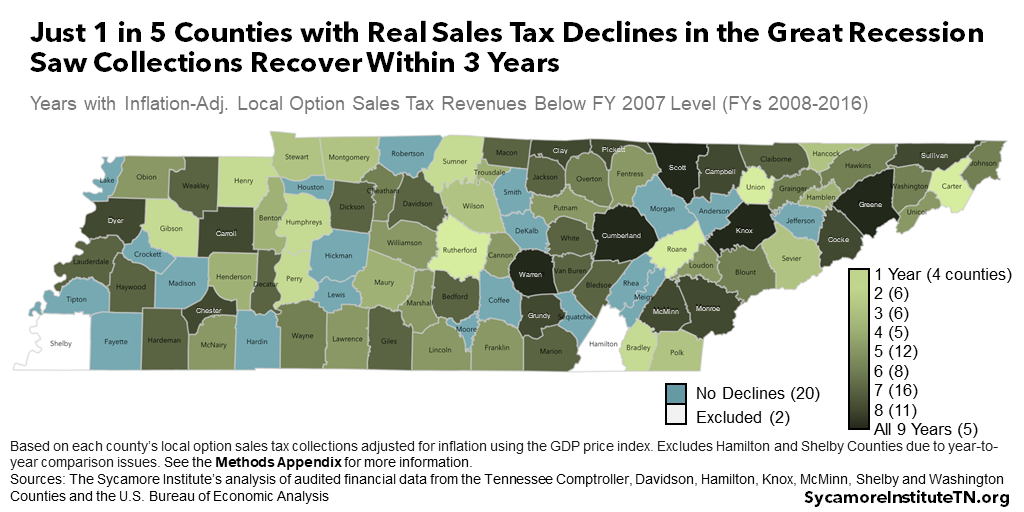

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Sales Tax Small Business Guide Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

Free 16 Boutique Business Plan Templates In Pdf Ms Word Within Clothing Store Busin Business Plan Template Free Business Plan Template Business Plan Example

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Income Tax Calculator Smartasset

Debits And Credit Cheat Sheet Debit Increase Revenue Business

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue